The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

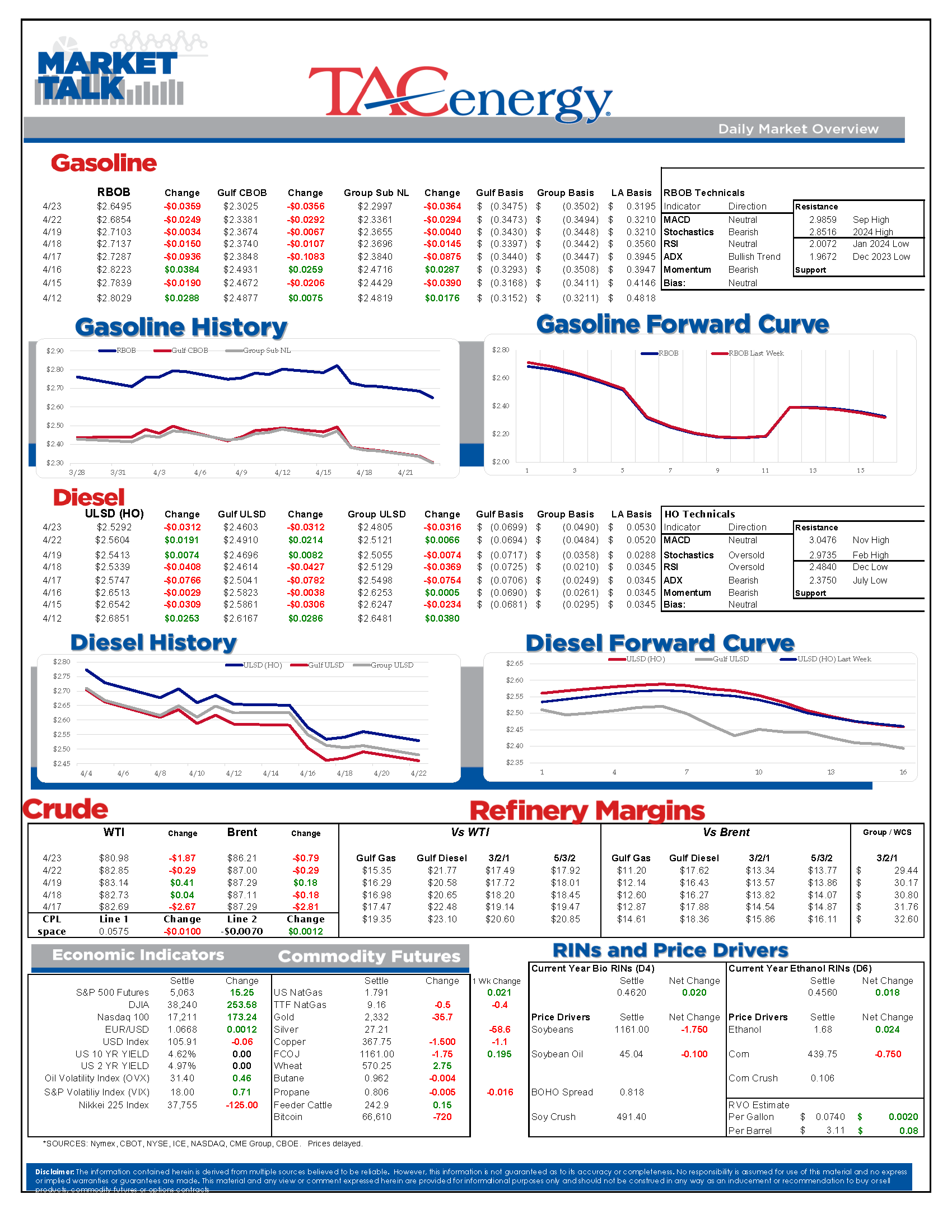

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

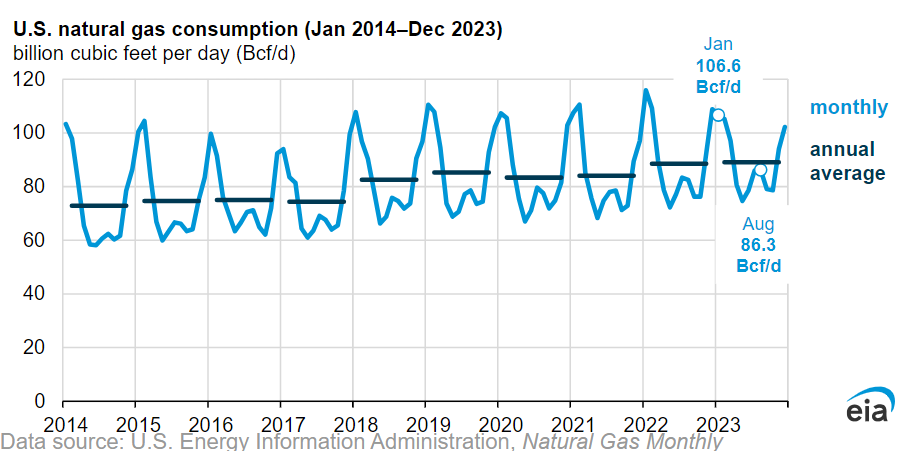

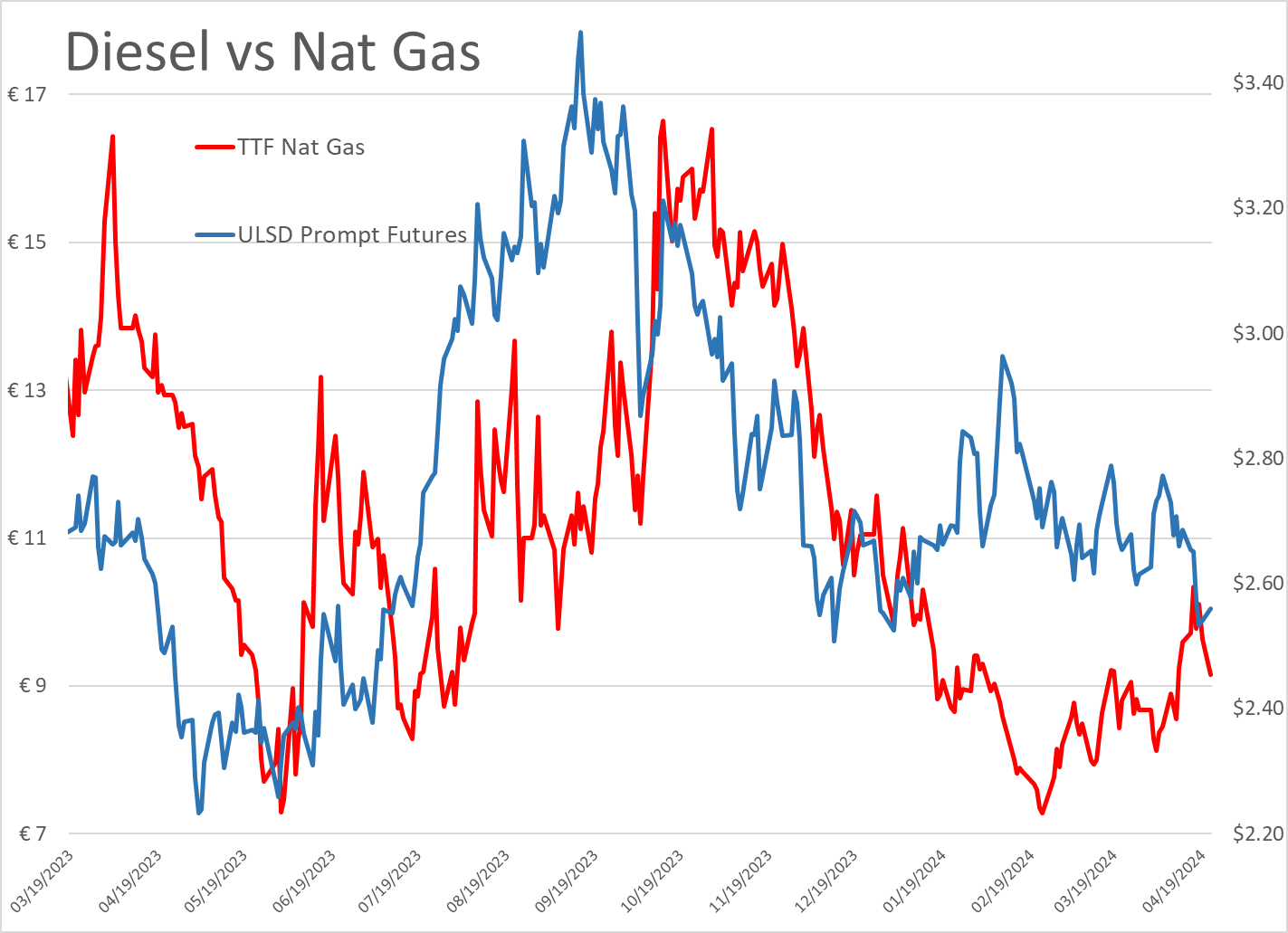

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

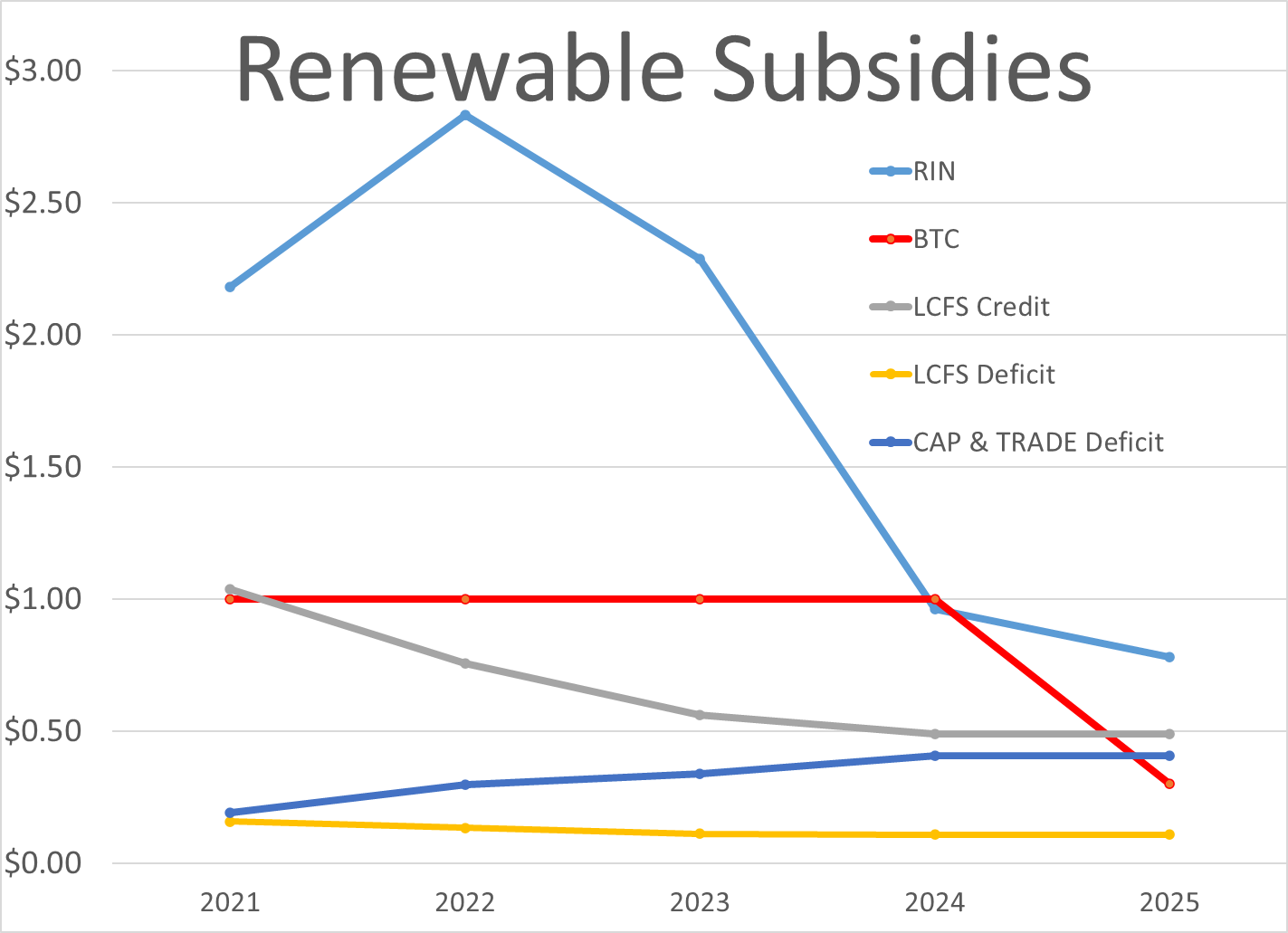

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 19 - US DOE Inventory Recap

Another Wave Of Selling Pushed Energy Futures To Fresh Multi-Month Lows On Tuesday

The search for a bottom continues after another wave of selling pushed energy futures to fresh multi-month lows on Tuesday. While most of the futures complex remains on the edge of a technical breakdown, we still haven’t seen the snowball effect of selling that signals the bulls (or more likely their trading algorithms) have finally thrown in the towel.

The most important technical test of the day comes from the RBOB futures contract that managed a modest bounce off of its 200-day moving average Tuesday, and could make a case for a recovery rally if it’s able to sustain a move higher from here. If that layer of support breaks however, there’s not much on the charts to prevent another 20 cents of losses.

We’re seeing a bit of the opposite reaction this morning to the May CPI report that came in just below expectations than we did yesterday when the PPI report showed inflation was still running hot. Both refined products added a penny in the first few minutes following the report, tagging along with a bounce in US equity futures. The annual inflation rate from the CPI came in at 3.4%, which is still well above the FED’s target of 2%, but the monthly rate of .3% was slightly lower than many estimates around .4%. Both the PPI and CPI reports showed the spring rally in fuel prices leading the tick up in inflation, which give us good reason to believe we’ll see lower numbers in June now that both gasoline and diesel futures have dropped 40 cents from their April highs.

ULSD futures hit their lowest level since July 5th of last year, which was just before the contract rallied more than $1/gallon in the next two months. Physical traders are also acting bearish on diesel contracts with more heavy selling in the LA and Group 3 markets which dropped to 14 cent discounts to futures Tuesday, but were left in the dust by Chicago values that collapsed to a 30 cent discount.

The latest crash in Chicago diesel basis combined with futures trading near a 10 month low pushed cash prices to the lowest level we’ve seen since December 2021, offering a seasonally unusual opportunity for those that are still waiting to lock in their fuel price for the next year.

The diesel overhang is also witnessed in the ongoing collapse in California LCFS credit values which reached an 8 year low Tuesday at $45/MT yesterday, down from $140/MT just over 2 years ago. The drop in LCFS values combined with last year’s collapse in RINs and the upcoming change to the blender’s tax credit has already caused the closure of a few biodiesel plants, a re-conversion of a refinery back to traditional fuels, and then Tuesday the world’s largest RD producer issued a profit warning due to a continued decrease in both diesel prices, and the subsidies for renewables. For those that lived through the early days of the ethanol industry that included multiple cycles of bankruptcies and frequent regulation changes wreaking havoc, this cycle on the diesel side of the barrel feels oddly similar.

The IEA continues to bang a bearish drum to try and counteract OPEC’s bullishness in their monthly reports, citing weak demand in Europe as a driver of OECD nations moving into fuel consumption contraction in the first quarter of 2024. The tax-payer funded agency also acknowledged the drop in refinery margins in April as the distillate glut continues across much of the world, while also noting that refinery run rates are set to increase further in the back half of the year. The report also noted that even if OPEC & Friends (now Rebranded as DoC) maintain their output cuts through 2025, growth in output from the US, Guyana, Canada and Brazil will be enough to keep world supply outpacing demand.

RIN prices got a quick bounce this week after a Federal Court denied a refinery suit against the EPA’s RFS rules for 2020-2022, but already gave back those gains yesterday, with D4 and D6 values holding around the $.45/RIN mark, down slightly from this time last year when they were worth about $1.50.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Prices Are Trading At Multi-Month Lows

Energy prices are trading at multi-month lows and are on the verge of a technical breakdown this morning after Monday’s attempted rally fizzled, and concerns over high inflation and low demand both seem to be keeping buyers at bay.

The complex was trading modestly lower overnight, and then the slide picked up steam following the April Producer Price Index (PPI) report which showed stubbornly high inflation of .5% for the month (which would annualize to 6%) giving the FED another reason to hold off on cutting interest rates. The bright side to this report is that the main contributor to April’s higher inflation reading was higher energy prices, and with the sharp pullback we’ve seen over the past month that component of pricing pressure should come down in the May report.

OPEC continues to bang a bullish drum in its monthly oil market report, increasing its economic estimates for Q1 of this year, and holding its forecasted demand growth steady at 2.8% and 2.9% for 2024 and 2025 respectively. The report also noted big decreases in clean-product tanker rates with east of Suez prices down 10% and West of Suez rates down 20%, in a sign that the physical market is not stressed over the potential shipping disruptions around the Middle East. Refinery margins declined across all major global markets as an end to a busy spring maintenance season and new capacity increased output.

What’s up Doc? The cartel also made a tweak to its monthly report and will now be highlighting output and demand for the countries participating in the Declaration of Cooperation (DoC…aka OPEC & Friends) to demonstrate solidarity and unity, which may signal that some in OPEC are getting nervous that the members may become more uncooperative in the coming months. Total OPEC output dipped by 48mb/day during April with declines in Nigeria and Iraq offsetting increases in Iran and the Congo. Total DoC output declined by 246mb/day during the month with Russia’s output declining by 154mb/day and Kazakhstan’s output down by 50mb/day.

Space on Colonial’s main diesel line (Line 2) settled in positive territory for the first time this year, as the building contango for distillates helps to incentivize shippers. There also appears to be another buildup of un-wanted inventory of distillates in several regional markets with basis values in LA, Chicago and the Group 3 market all reaching multi-month lows this week.

Some of the weakness in diesel prices can be blamed on recent wet weather delaying planting in several states, and those delays are also helping corn and ethanol prices rebound to approach their highest levels of the year.

New tariffs on Chinese EV’s are making headlines this week, but it’s a potential tariff on Used Cooking Oil (UCO) from China that could have a larger impact near term on the fuel industry as US grain processor think it’s unfair that China dares recycle oil to the detriment of their food to fuel factories.

Speaking of EV’s, the EIA this morning wrote that the US share of electric and hybrid vehicle sales decreased on the first quarter of 2024 after more than 3 years of steady growth.

Click here to download a PDF of today's TACenergy Market Talk.