News Archive

Market Talk - 2018 september

Sign up to receive market talk updates in your inbox each day.

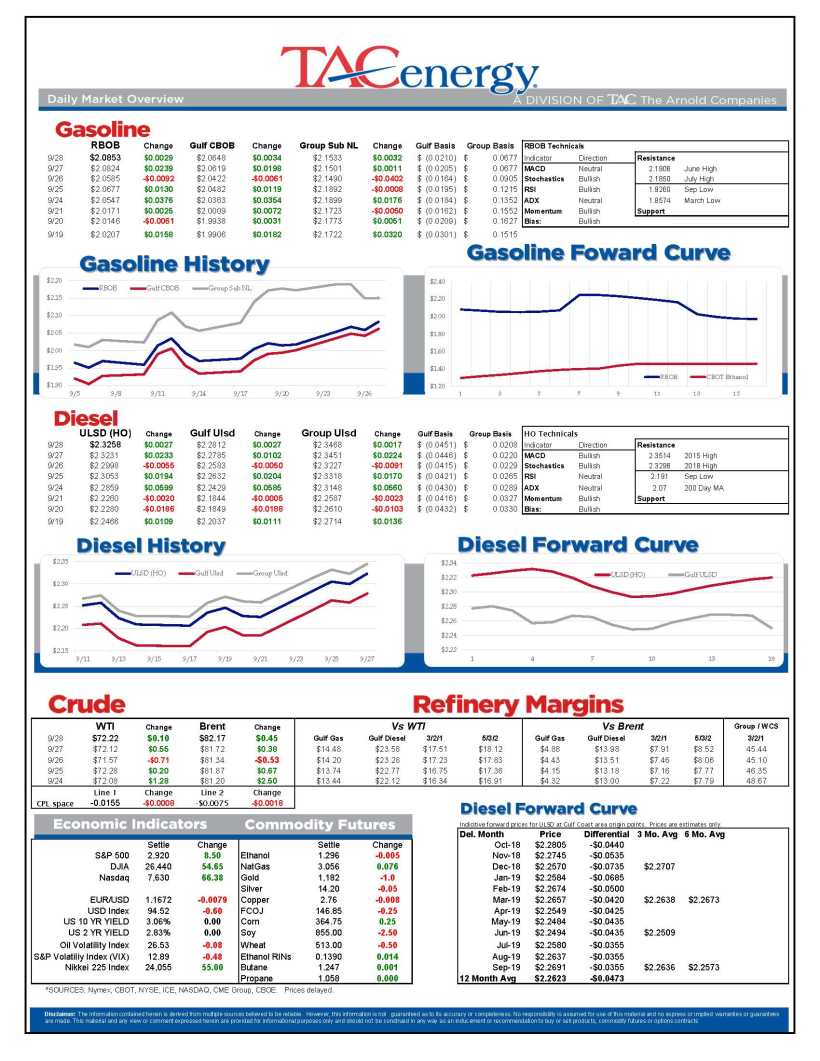

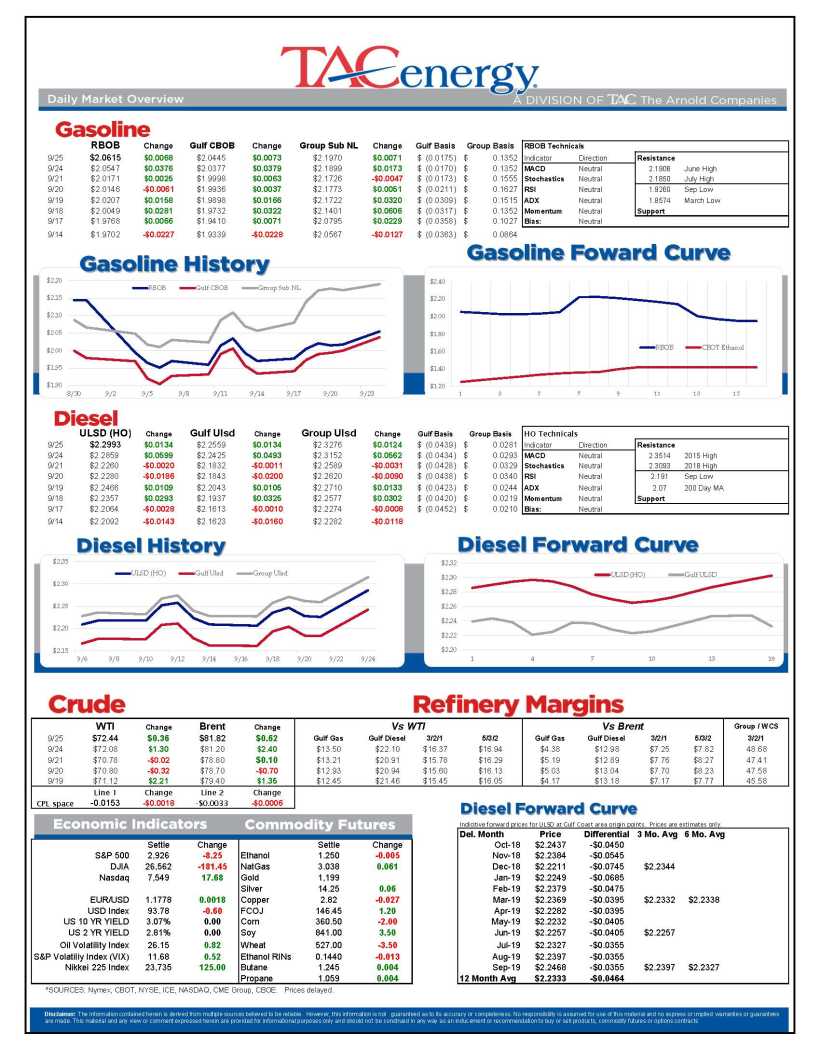

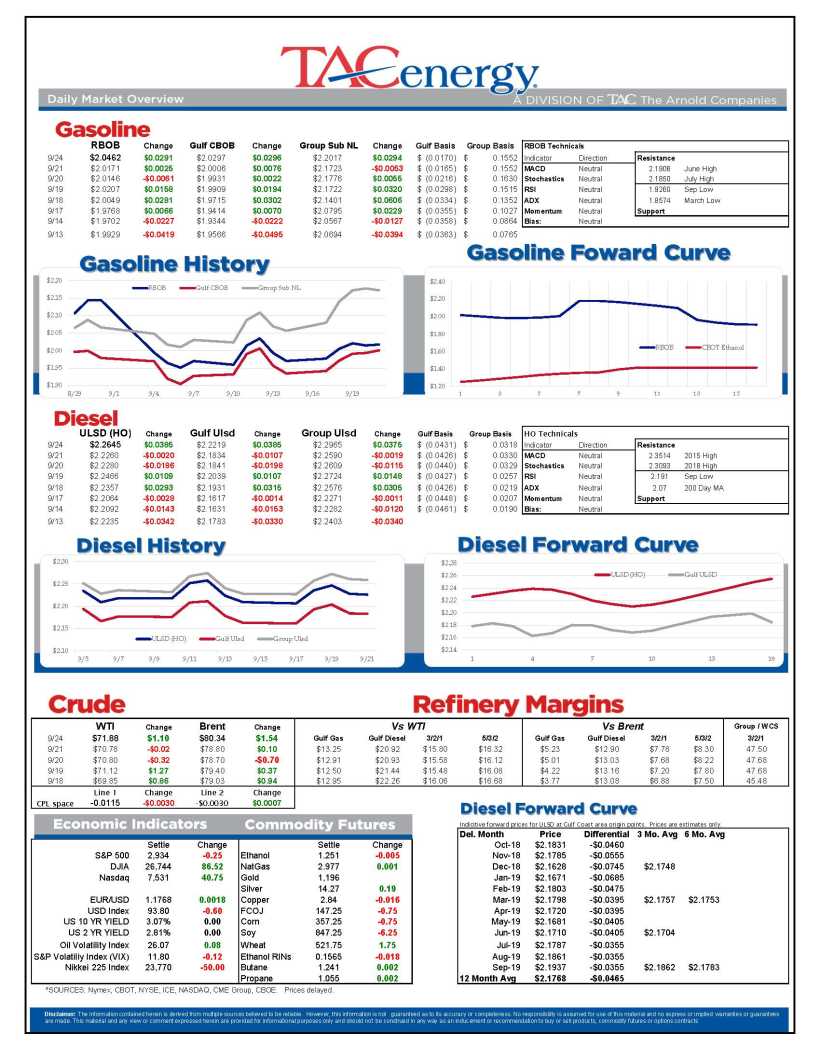

Energy Prices Holding Onto Modest Gains

Energy prices are holding onto modest gains as trading winds down on a strong week, month, and quarter for the petroleum complex. As Bloomberg noted this morning, this will mark a 5th straight quarter of gains for Brent crude oil prices, something we haven’t witnessed since the rally from $70 to $145 more than 10 years ago.

While Brent Crude & ULSD futures are trading near 4-year highs, WTI and RBOB futures are still holding below their summer levels, setting up an interesting tug-of-war for control of the petroleum complex as we enter the 4th quarter.

While concerns about global supply reductions (driven largely by Iranian sanctions and Venezuelan chaos) have helped fuel the rally this year, rising oil prices combined with rising interest rates and a stronger dollar are threatening to derail demand growth in emerging economies which could help prices stabilize in the coming year.

The US Justice department and EPA announced Thursday they’d reached a settlement with NGL over fraudulent RIN activity by Gavilon LLC prior to NGL’s acquisition of that company. The settlement included a $25 million penalty and a retirement of 10 million RINs.

Coincidentally, RIN markets have reached 5 year lows this week after the EPA released new data on the Renewable Fuel Standard which showed plenty of RINs available to meet obligations, and as rumors circulate that a new deal to satiate big Ag and Big Oil may be coming ahead of the mid-term elections.

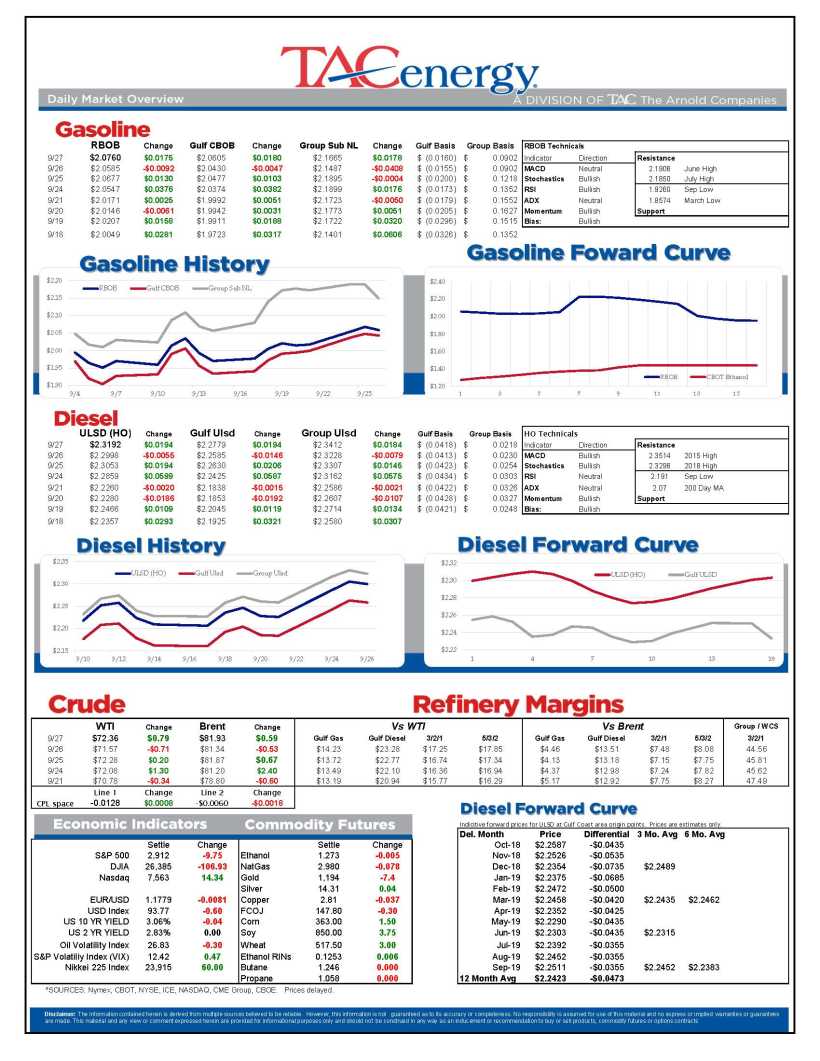

Rally In Energy Prices Has Resumed

After a 1-day break, the rally in energy prices has resumed Thursday with Brent crude back above $82, and ULSD futures reaching their highest since February 2015. Concerns over Iranian sanctions continue to take most of the blame in headlines for the move higher while some bearish data points in Wednesday’s DOE report have quickly become yesterday’s news.

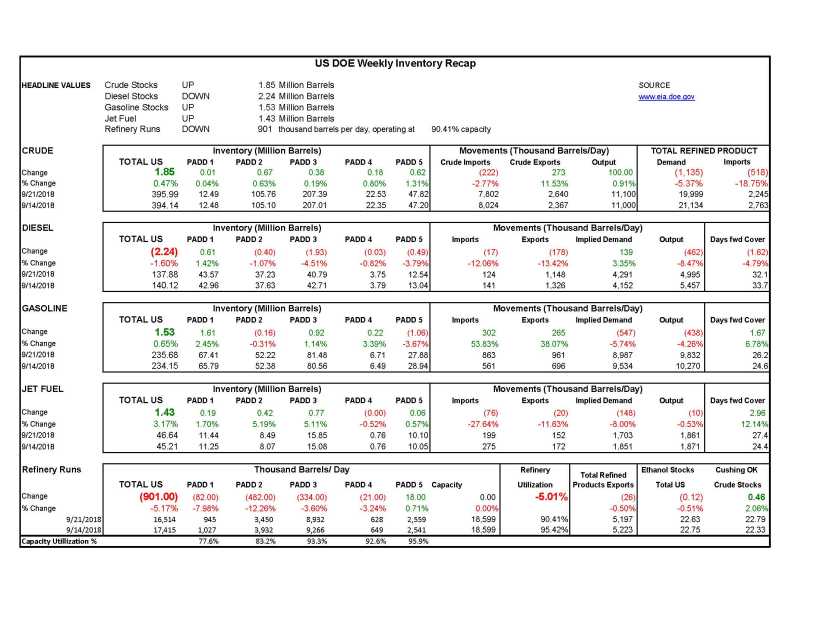

US Crude inventories built modestly as US production reached a record high at 11.1 million barrels/day. That production figure is 1.5 million barrels/day more than what the US was producing at this time last year.

Refinery runs dropped by more than 5% on the week, led by a dramatic drop in PADD 2 (Midwest) runs of nearly ½ million barrels/day as a busy fall maintenance season appears to be coming to fruition. Several reports over the past year suggest that we may see more refinery maintenance than normal in the next year as plants prepare for the spec change in Marine diesel starting in 2020.

Total petroleum demand saw another large slump last week as the DOE’s estimate for gasoline fell by more than ½ million barrels/day last week, dropping below 9 million barrels/day for the first time since May.

As expected, the FOMC raised interest rates for a 3rd time this year, and suggested it would stick with its plan to raise rates a 4th time in December. Equity markets initially rallied as the statement omitted a sentence from previous meetings that suggested the FED was looking more dovish on rates, but that optimism was short lived as US stocks sold off heavily into the close.

In other news, Energy Secretary Rick Perry said yesterday that the US is not considering a release of the SPR to offset the impact of sanctions on Iran.

Nearly 5.5 years after the FBI raid that shocked the industry, the former president of PFJ was sentenced to more than 12 years in prison for his role in a scheme to defraud customers.

US Crude Stocks Threw Cold Water On Petroleum Price Rally

A build in US crude stocks threw a bit of cold water on the petroleum price rally Tuesday afternoon, offsetting the flow of hot air coming out of the UN assembly in New York. ULSD futures did manage to join Brent crude in reaching its highest level in nearly 4 years before the pullback began.

The API was said to report a build in crude oil stocks of 2.9 million barrels last week that sparked a late afternoon sell-off that’s carried through the overnight session. Gasoline stocks were said to increase by roughly 949,0000 barrels, while distillates declined by 944,000 barrels. The DOE’s weekly recap is due out at its regular time this morning.

Brent’s outperformance compared to the other petroleum contracts this week has highlighted logistical challenges causing north American grades to trade at steep discounts (WTI in midland is around $25/barrel cheaper than Brent, and WCS was more than $43/barrel cheaper). Meanwhile, the European benchmark is facing the opposite problem as declining production in the north sea risks making the contract less relevant, forcing the contract’s pricing agency to consider a revamp of the crude grades allowed to make up the Brent reference price.

The FOMC wraps up its 2 day meeting today, and traders are giving a 100% probability of some rate increase when their statement is announced at 1pm central. According to the CME’s Fedwatch tool, there’s an 83% probability priced into futures of another rate increase in December, so unless we see some deviation from this plan, there may not be a large market reaction given the high levels of confidence in the FED’s actions.

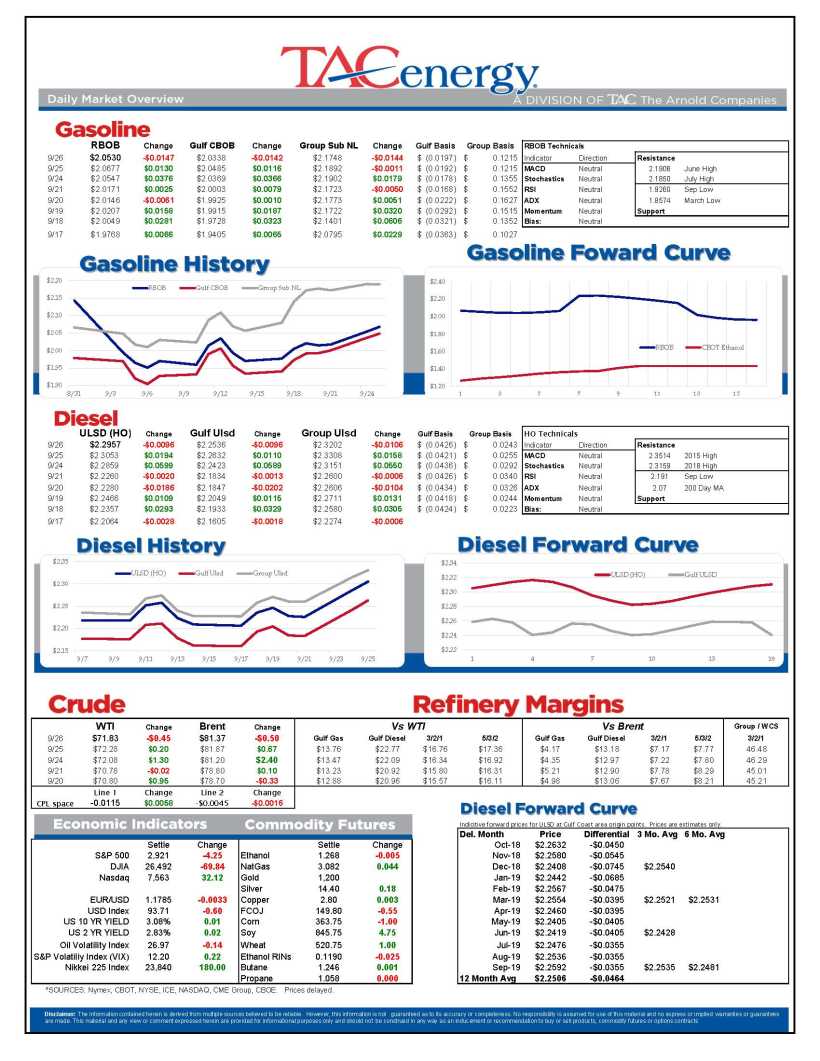

Push Higher Continues For Energy Prices

The push higher continues for energy prices following the OPEC & Friend’s decision to leave official output quotas unchanged over the weekend. Brent crude reached a new high north of $82 overnight, reaching its highest level since November 2014

While Brent is surging to 46 month highs, North American grades aren’t faring quite as well with WTI nearly $10/barrel lower than Brent and Western Canadian grades now nearly $43/barrel below its Western European counterpart. WCS reached a record discount to WTI in Monday’s session as logistical bottlenecks continue to hamper land-locked oil prices.

Right on cue, the CME Group announced its plans to launch a new WTI Futures contract with delivery points in Houston, which it said will complement the benchmark WTI contract that delivers in Cushing OK, and will compete with the ICE’s Houston contract that began trading earlier in the year.

The FED’s Open Market Committee (FOMC) begins a 2-day meeting today, and according to the CME’s FEDWATCH tool, traders are giving a 100% probability of at least a 25 point interest rate increase being announced tomorrow afternoon, while 6.2% are predicting the increase could be 50 points. 10 year treasury prices are approaching a 7 year high as it appears the FED is eager to continue its rate hikes.

Brent Crude Oil Prices Reached Their Highest

Brent crude oil prices reached their highest in nearly 4 years overnight, trading just shy of $81/barrel after a meeting of OPEC and Friends over the weekend ended with no new pledges to boost oil production.

It seems the cartel agrees that $80/barrel is a high enough price (and some think it’s too high) but the group says it will wait until the November meeting to see how sanctions on Iran will impact global supplies before making any official changes.

Money managers seems a bit conflicted on energy prices last week. Net length held by the speculative category of trader increased for a 4th straight week for Brent contracts, but declined for a 2nd week in WTI and ULSD, while RBOB saw a modest tick higher after dropping last week.

Baker Hughes reported a net decrease of 1 oil rig in the US last week.

RIN values dropped further to multi-year lows last week after the EPA updated its website to provide more information on the Renewable Fuel Standard program.