It’s A Quiet Start To Trading As The 2nd Quarter Of 2023 Winds Down

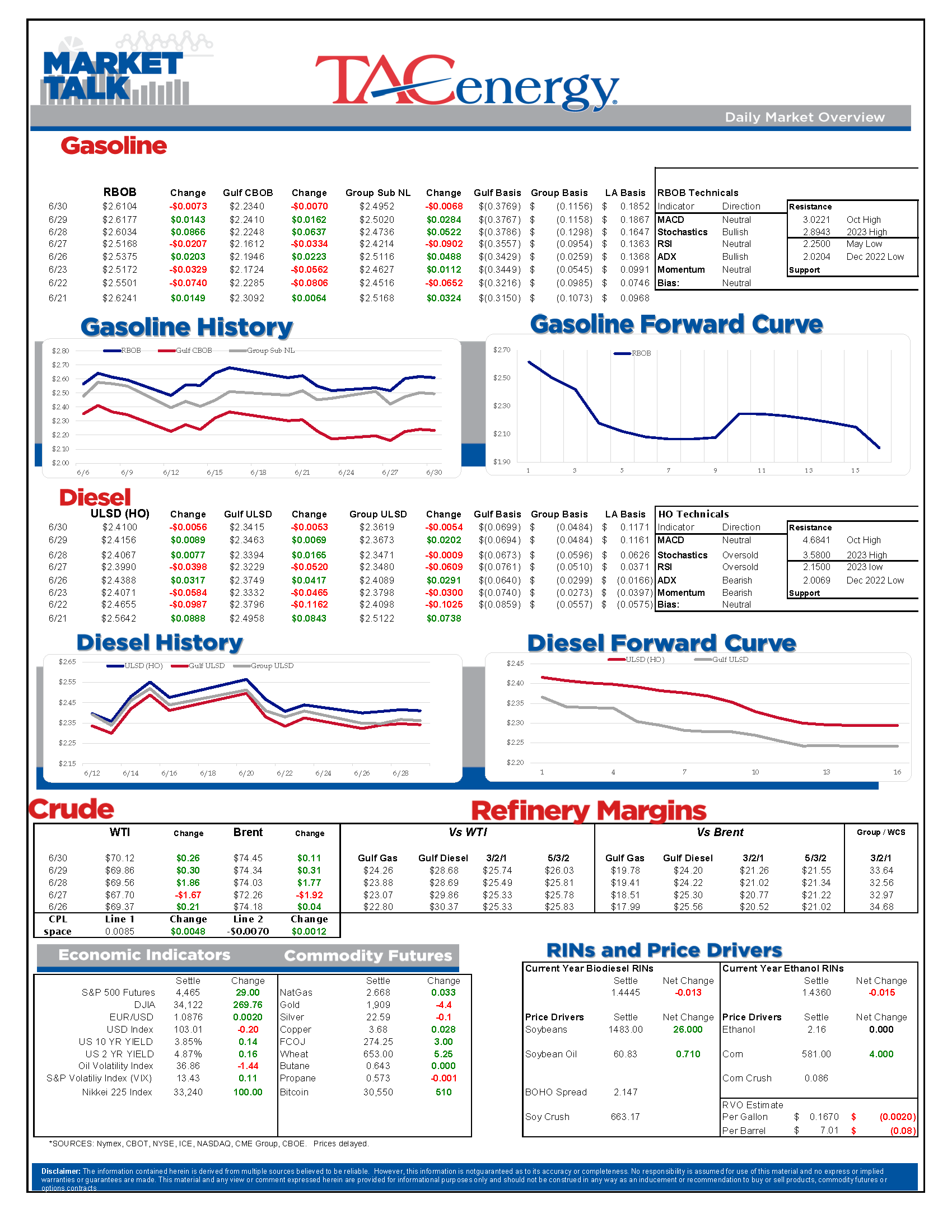

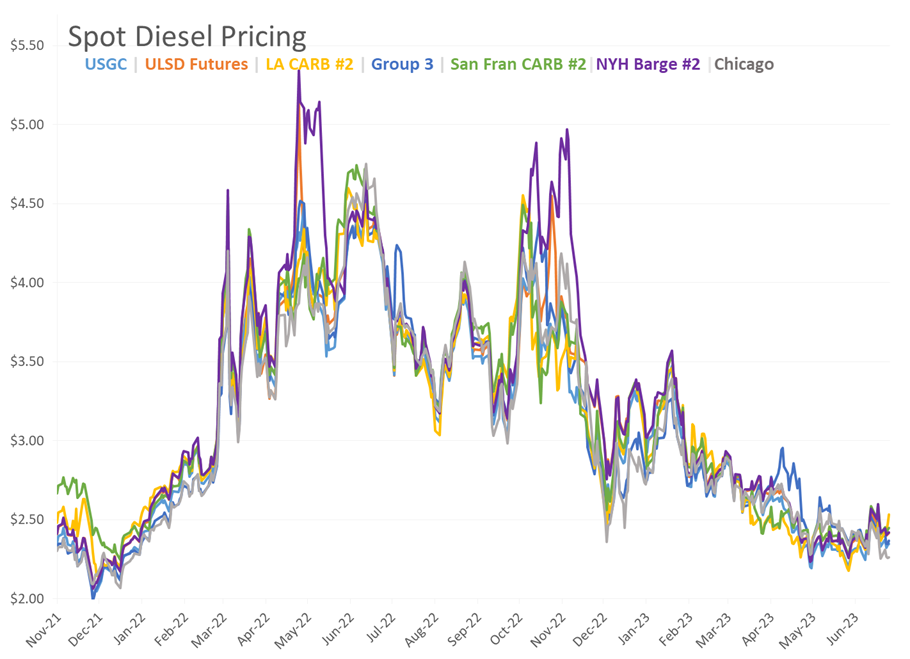

It’s a quiet start to trading as the 2nd quarter of 2023 winds down, with many already looking ahead to a long holiday weekend. While most energy contracts are poised to finish the month higher, they’re still lower than they were at the end of Q1, with plenty of work to be done if the bulls are going to regain control. Diesel futures are down $1.50/gallon from this time last year, while gasoline futures are down more than $1 and the charts continue to send mixed signals for what’s ahead.

Almost all trading has shifted away from the expiring July RBOB and ULSD contracts, so look to the August figures for direction today if your market hasn’t already rolled.

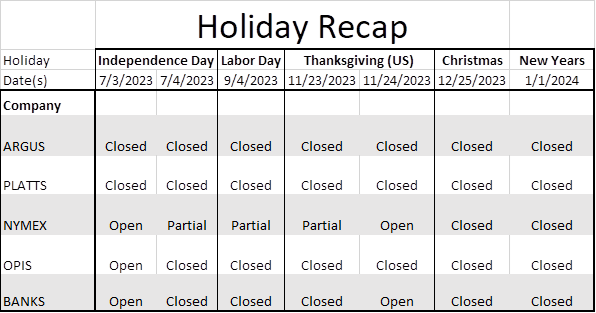

See the holiday calendar below for a recap of who is and isn’t open to start next week. Monday will be particularly confusing for rack pricing as the Nymex and OPIS both have normal publishing plans but Argus and Platts will both be closed.

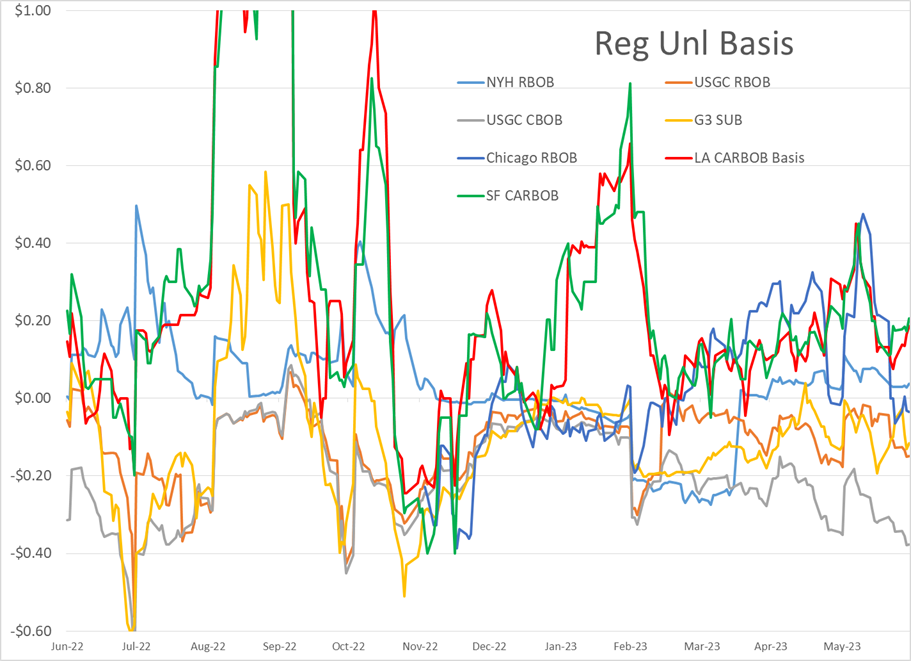

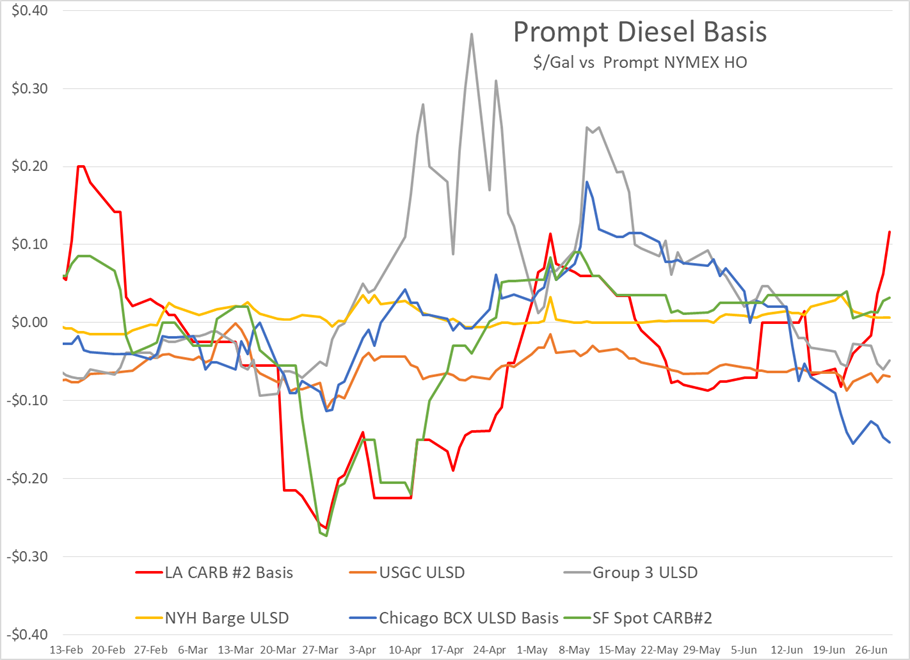

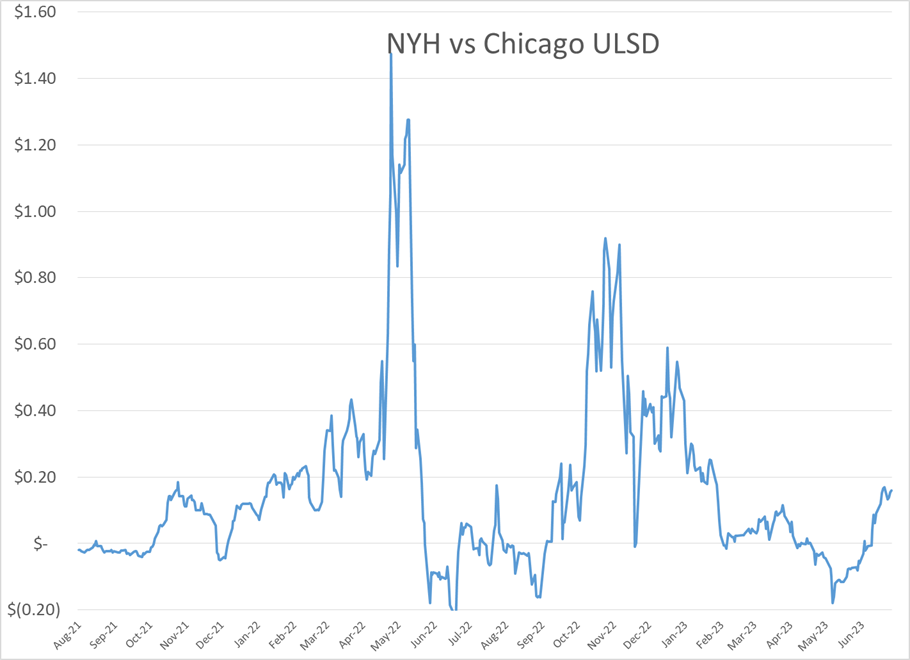

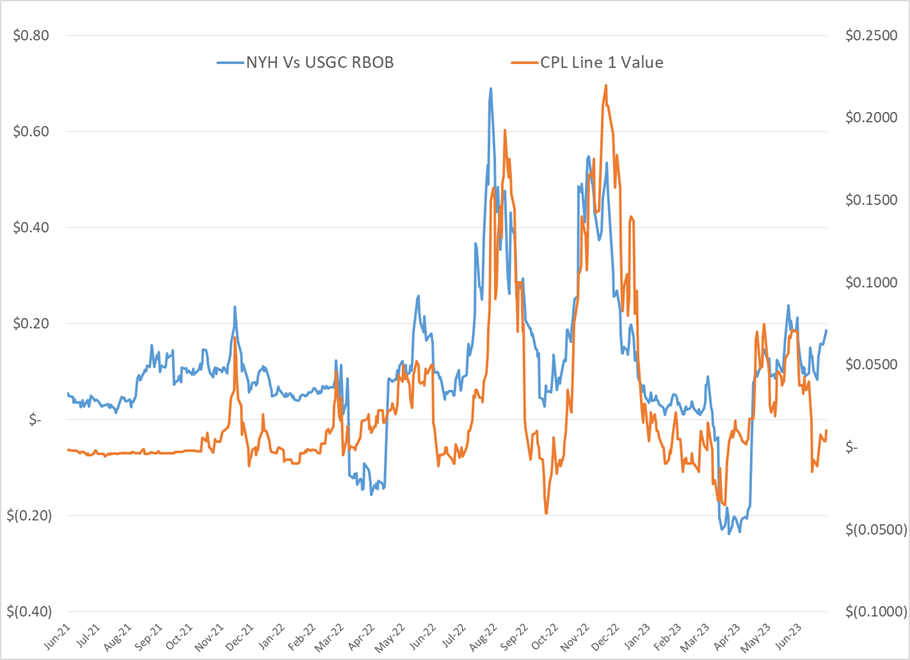

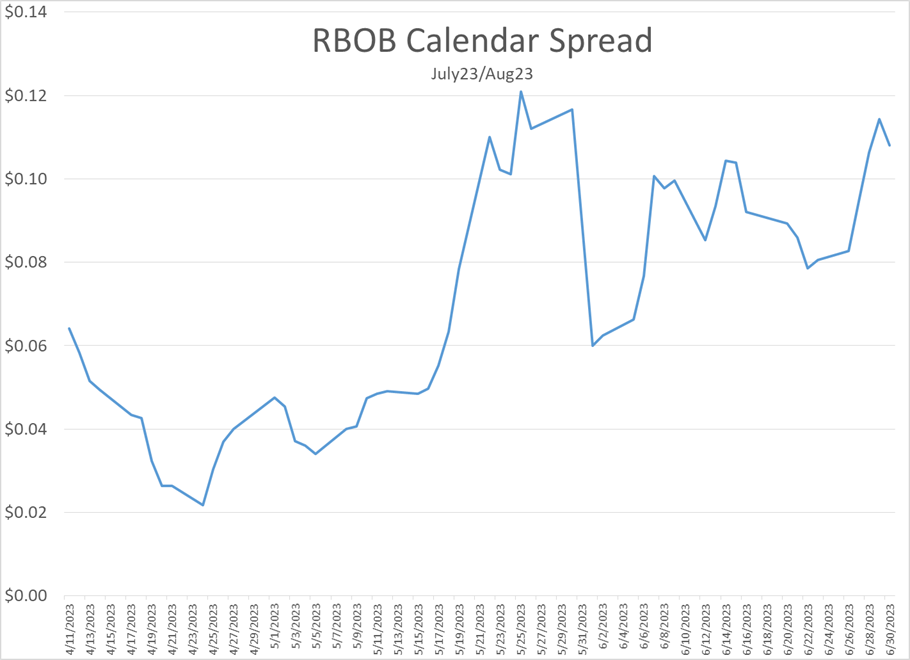

The East Coast continues to show signs that physical supply is tightening up after a relatively relaxed spring. Colonial line 1 premiums jumped back into positive territory as gasoline values in NYH relative to the Gulf Coast have gained 10 cents/gallon over the past 10 days. Distillates are seeing strength as well with NYH spots now going for nearly 20 cents/gallon more than the Chicago market and 7 cents above the Gulf Coast.

The West Coast is also seeing strength, with gasoline and diesel basis in California seeing healthy gains this week following multiple refinery upsets. The strength is primarily focused in the LA area, with CARB diesel premiums hitting their highest levels since February yesterday.

The 4th largest refinery in the US continues to struggle, reporting 2 more-unit upsets to regulators Thursday, just 2 days after a chemical leak sparked a shelter in place and less than 2 months after a deadly fire. Gulf Coast basis markets continue to shrug off this news with basis values not making any perceived moves due to those upsets while regional inventories remain at average levels even though exports remain robust.

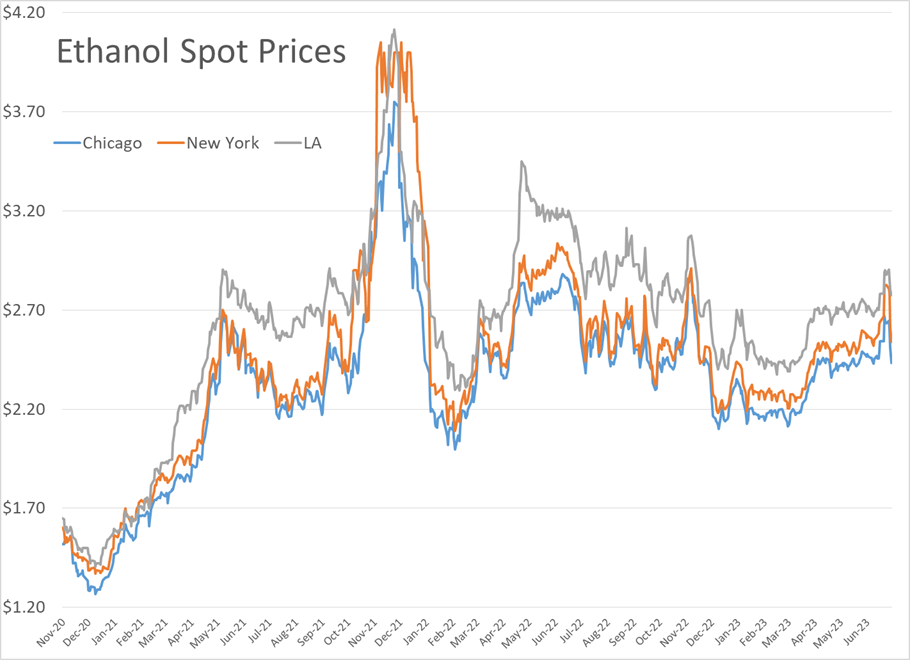

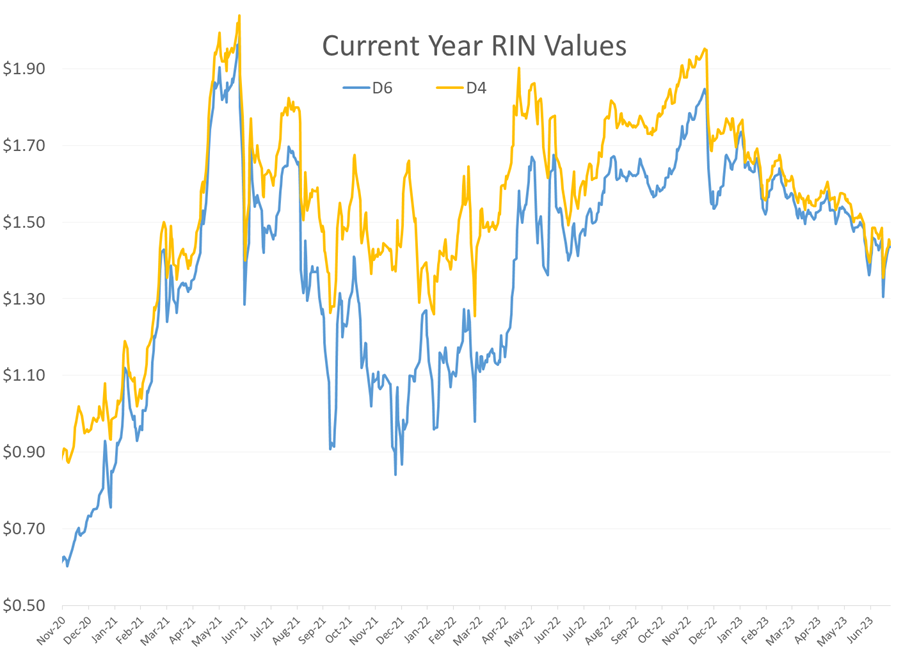

Ethanol RINs (D6) have recovered the losses they took after the EPA announced it was lowering its de-facto ethanol blending requirements for the next two years, even though outright ethanol prices have dropped by more than 20 cents/gallon in the past 3 days, which are following a sharp drop off in corn and other grain prices as drought fears across the Midwest seem to be coming to an end. D4 RINs are now trading essentially flat to D6 RINs, a far cry from the 20 cent premiums they carried for much of last year, thanks to the rapid influx of new renewable diesel production. Of course, even though the RIN values are the same, the total value for RD production is much higher as each gallon produced generates 1.7 RINs, vs 1.5 for biodiesel and 1 for ethanol.

The EPA announced new rules to prevent PFAS chemicals to enter the marketplace. That new framework could be another nail in the coffin of the beleaguered Suncor refinery near Denver, as a new report notes a spike in PFAS from that facility in May, adding to the comedy of errors experienced by that company over the past year.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

The Recovery Rally In Energy Markets Continues For A 3rd Day

The recovery rally in energy markets continues for a 3rd day with refined product futures both up more than a dime off of the multi-month lows we saw Wednesday morning. The DJIA broke 40,000 for the first time ever Thursday, and while it pulled back yesterday, US equity futures are suggesting the market will open north of that mark this morning, adding to the sends of optimism in the market.

Despite the bounce in the back half of the week, the weekly charts for both RBOB and ULSD are still painting a bearish outlook with a lower high and lower low set this week unless the early rally this morning can pick up steam in the afternoon. It does seem like the cycle of liquidation from hedge funds has ended however, so it would appear to be less likely that we’ll see another test of technical support near term after this bounce.

Ukraine hit another Russian refinery with a drone strike overnight, sparking a fire at Rosneft’s 240mb/day Tuapse facility on the black sea. That plant was one of the first to be struck by Ukrainian drones back in January and had just completed repairs from that strike in April. The attack was just one part of the largest drone attack to date on Russian energy infrastructure overnight, with more than 100 drones targeting power plants, fuel terminals and two different ports on the Black Sea. I guess that means Ukraine continues to politely ignore the White House request to stop blowing up energy infrastructure in Russia.

Elsewhere in the world where lots of things are being blown up: Several reports of a drone attack in Israel’s largest refining complex (just under 200kbd) made the rounds Thursday, although it remains unclear how much of that is propaganda by the attackers and if any impact was made on production.

The LA market had 2 different refinery upsets Thursday. Marathon reported an upset at the Carson section of its Los Angeles refinery in the morning (the Carson facility was combined with the Wilmington refinery in 2019 and now reports as a single unit to the state, but separately to the AQMD) and Chevron noted a “planned” flaring event Thursday afternoon. Diesel basis values in the region jumped 6 cents during the day. Chicago diesel basis also staged a recovery rally after differentials dropped past a 30 cent discount to futures earlier in the week, pushing wholesale values briefly below $2.10/gallon.

So far there haven’t been any reports of refinery disruptions from the severe weather than swept across the Houston area Thursday. Valero did report a weather-related upset at its Mckee refinery in the TX panhandle, although it appears they avoided having to take any units offline due to that event.

The Panama Canal Authority announced it was increasing its daily ship transit level to 31 from 24 as water levels in the region have recovered following more than a year of restrictions. That’s still lower than the 39 ships/day rate at the peak in 2021, but far better than the low of 18 ships per day that choked transit last year.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Prices Found A Temporary Floor After Hitting New Multi-Month Lows Wednesday

Energy prices found a temporary floor after hitting new multi-month lows Wednesday morning as a rally to record highs in US equity markets and a modestly bullish DOE report both seemed to encourage buyers to step back into the ring.

RBOB and ULSD futures both bounced more than 6 cents off of their morning lows, following a CPI report that eased inflation fears and boosted hopes for the stock market’s obsession of the FED cutting interest rates. Even though the correlation between energy prices and equities and currencies has been weak lately, the spillover effect on the bidding was clear from the timing of the moves Wednesday.

The DOE’s weekly report seemed to add to the optimism seen in equity markets as healthy increases in the government’s demand estimates kept product inventories from building despite increased refinery runs.

PADD 3 diesel stocks dropped after large increases in each of the past 3 weeks pushed inventories from the low end of their seasonal range to average levels. PADD 2 inventories remain well above average which helps explain the slump in mid-continent basis values over the past week. Diesel demand showed a nice recovery on the week and would actually be above the 5 year average if the 5% or so of US consumption that’s transitioned to RD was included in these figures.

Gasoline inventories are following typical seasonal patterns except on the West Coast where a surge in imports helped inventories recover for a 3rd straight week following April’s big basis rally.

Refiners for the most part are also following the seasonal script, ramping up output as we approach the peak driving demand season which unofficially kicks off in 10 days. PADD 2 refiners didn’t seem to be learning any lessons from last year’s basis collapse and rapidly increased run rates last week, which is another contributor to the weakness in midwestern cash markets. One difference this year for PADD 2 refiners is the new Transmountain pipeline system has eroded some of their buying advantage for Canadian crude grades, although those spreads so far haven’t shrunk as much as some had feared.

Meanwhile, wildfires are threatening Canada’s largest oil sands hub Ft. McMurray Alberta, and more than 6,000 people have been forced to evacuate the area. So far no production disruptions have been reported, but you may recall that fires in this region shut in more than 1 million barrels/day of production in 2016, which helped oil prices recover from their slump below $30/barrel.

California’s Air Resources Board announced it was indefinitely delaying its latest California Carbon Allowance (CCA) auction – in the middle of the auction - due to technical difficulties, with no word yet from the agency when bidders’ security payments will be returned, which is pretty much a nice microcosm for the entire Cap & Trade program those credits enable.