The Drop In Diesel Prices Is Being Blamed On The Economic Slowdown In Europe

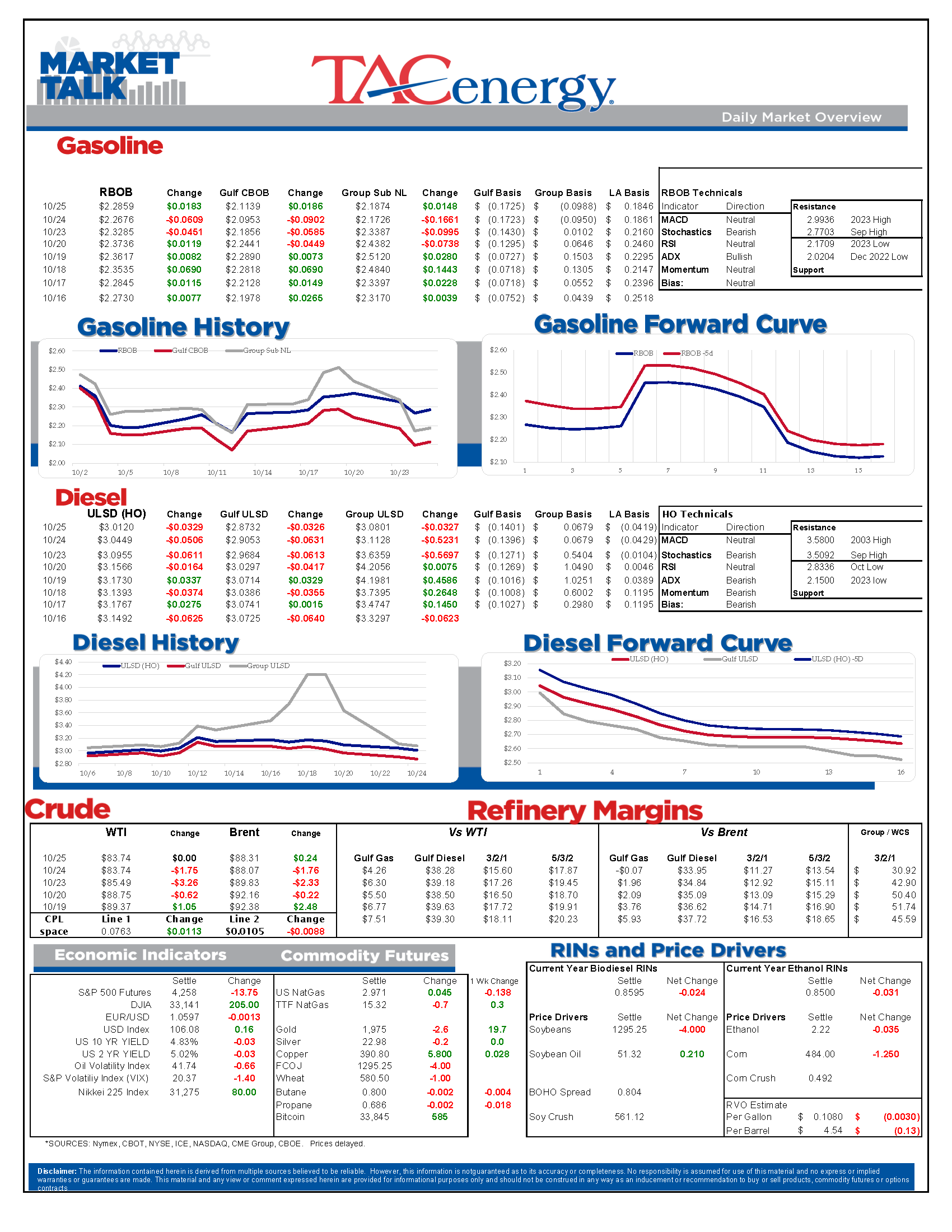

ULSD futures are trading lower for a 4th straight day with early losses around 3 cents for the November contract, marking a 20 cent drop from Friday’s highs. RBOB gasoline futures are heading the opposite direction in the early going, with 2.5 cent gains taking back some of yesterday’s big losses.

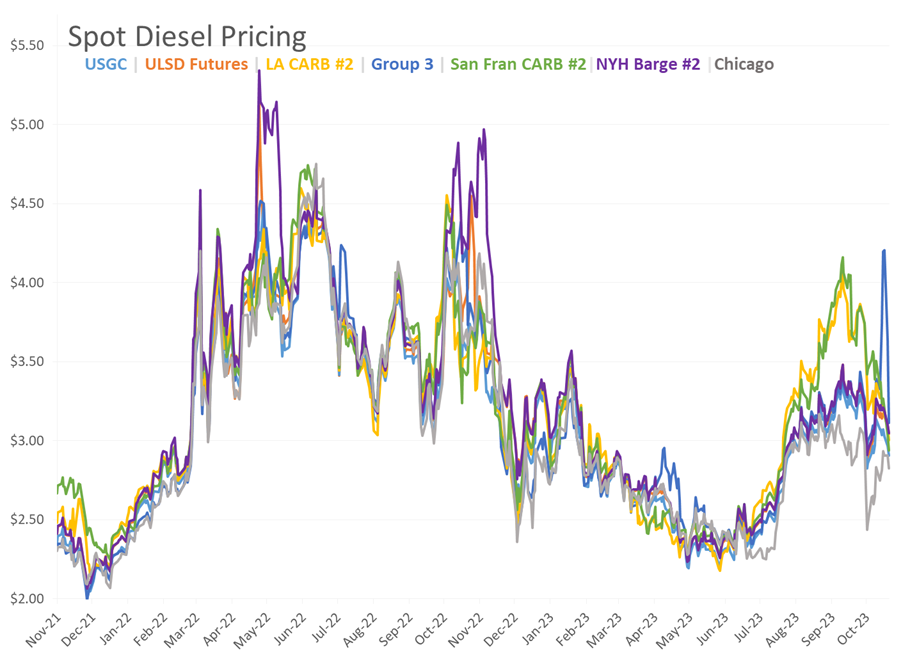

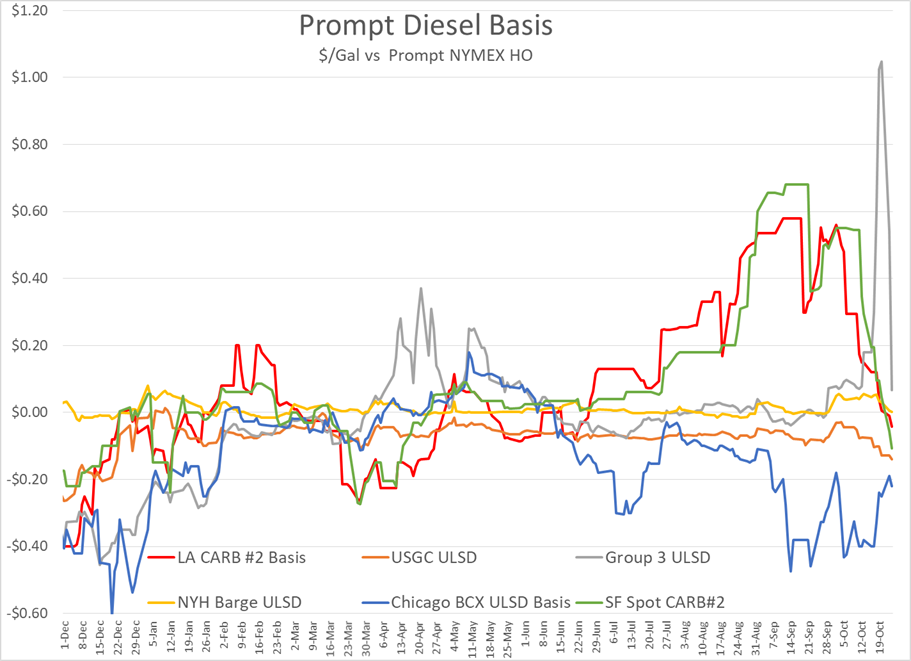

Much of the drop in diesel prices is being blamed on the economic slowdown in Europe, which was highlighted this week by weak manufacturing and spending data from Germany and France. The diesel weakness isn’t limited to futures trading, with basis markets across the country moving lower this week, and most regional cash markets trading now trading at a discount to futures.

Headlines continue to suggest that de-escalation of the war in Gaza is the reason prices have pulled back, even though attacks on US and Israeli targets from Iran-backed groups has surged in recent days. Perhaps more important than the diplomacy hopes is that Saudi-Arabia’s long time opponent Yemen fired cruise missiles that were intercepted by a US naval ship and Saudi defenses, which is a sure sign that the world’s biggest oil exporter is unlikely to join forces with the Iranians as they did 50 years ago.

The API reported inventory declines across the board last week with gasoline stocks down 4.2 million barrels, diesel down 2.3 million and crude oil down 2.7 million barrels. The EIA’s weekly report is due out at its normal time today, but the agency has given notice that its reports two weeks from now will be delayed to complete a system upgrade.

China is reining in the rampant refinery expansions we’ve seen the past couple of years, by setting a national capacity cap and minimum size limits on new facilities. It appears that these new regulations won’t impact the new facilities under construction, so near term, the country is still poised to control the refined product trade flows to and from Asia, depending of course on what the Politburo allows those facilities to do.

A Bloomberg opinion piece this week highlights the recent challenges for gasoline margins at the refining level, and notes how the Middle East flare up makes the rationalization process for refining more complicated. For those that prefer the cliff notes version: “The economically rational response would be to close less competitive refineries, leaving room for the largest, most advanced plants to run profitably. But 50 years on from an attack on Israel that sparked the first oil crisis, and with the Middle East in turmoil once more, economic rationality counts for only so much in a world where energy security is again in focus. Pressure on gasoline margins will challenge governments as much as it will refiners themselves.”

Valero reported an upset at its Three Rivers refinery in South Texas Thursday, with unplanned flaring expected to last 24 hours. This comes a day after a power loss impacted multiple facilities in the Corpus Christi area.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

The Recovery Rally In Energy Markets Continues For A 3rd Day

The recovery rally in energy markets continues for a 3rd day with refined product futures both up more than a dime off of the multi-month lows we saw Wednesday morning. The DJIA broke 40,000 for the first time ever Thursday, and while it pulled back yesterday, US equity futures are suggesting the market will open north of that mark this morning, adding to the sends of optimism in the market.

Despite the bounce in the back half of the week, the weekly charts for both RBOB and ULSD are still painting a bearish outlook with a lower high and lower low set this week unless the early rally this morning can pick up steam in the afternoon. It does seem like the cycle of liquidation from hedge funds has ended however, so it would appear to be less likely that we’ll see another test of technical support near term after this bounce.

Ukraine hit another Russian refinery with a drone strike overnight, sparking a fire at Rosneft’s 240mb/day Tuapse facility on the black sea. That plant was one of the first to be struck by Ukrainian drones back in January and had just completed repairs from that strike in April. The attack was just one part of the largest drone attack to date on Russian energy infrastructure overnight, with more than 100 drones targeting power plants, fuel terminals and two different ports on the Black Sea. I guess that means Ukraine continues to politely ignore the White House request to stop blowing up energy infrastructure in Russia.

Elsewhere in the world where lots of things are being blown up: Several reports of a drone attack in Israel’s largest refining complex (just under 200kbd) made the rounds Thursday, although it remains unclear how much of that is propaganda by the attackers and if any impact was made on production.

The LA market had 2 different refinery upsets Thursday. Marathon reported an upset at the Carson section of its Los Angeles refinery in the morning (the Carson facility was combined with the Wilmington refinery in 2019 and now reports as a single unit to the state, but separately to the AQMD) and Chevron noted a “planned” flaring event Thursday afternoon. Diesel basis values in the region jumped 6 cents during the day. Chicago diesel basis also staged a recovery rally after differentials dropped past a 30 cent discount to futures earlier in the week, pushing wholesale values briefly below $2.10/gallon.

So far there haven’t been any reports of refinery disruptions from the severe weather than swept across the Houston area Thursday. Valero did report a weather-related upset at its Mckee refinery in the TX panhandle, although it appears they avoided having to take any units offline due to that event.

The Panama Canal Authority announced it was increasing its daily ship transit level to 31 from 24 as water levels in the region have recovered following more than a year of restrictions. That’s still lower than the 39 ships/day rate at the peak in 2021, but far better than the low of 18 ships per day that choked transit last year.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Prices Found A Temporary Floor After Hitting New Multi-Month Lows Wednesday

Energy prices found a temporary floor after hitting new multi-month lows Wednesday morning as a rally to record highs in US equity markets and a modestly bullish DOE report both seemed to encourage buyers to step back into the ring.

RBOB and ULSD futures both bounced more than 6 cents off of their morning lows, following a CPI report that eased inflation fears and boosted hopes for the stock market’s obsession of the FED cutting interest rates. Even though the correlation between energy prices and equities and currencies has been weak lately, the spillover effect on the bidding was clear from the timing of the moves Wednesday.

The DOE’s weekly report seemed to add to the optimism seen in equity markets as healthy increases in the government’s demand estimates kept product inventories from building despite increased refinery runs.

PADD 3 diesel stocks dropped after large increases in each of the past 3 weeks pushed inventories from the low end of their seasonal range to average levels. PADD 2 inventories remain well above average which helps explain the slump in mid-continent basis values over the past week. Diesel demand showed a nice recovery on the week and would actually be above the 5 year average if the 5% or so of US consumption that’s transitioned to RD was included in these figures.

Gasoline inventories are following typical seasonal patterns except on the West Coast where a surge in imports helped inventories recover for a 3rd straight week following April’s big basis rally.

Refiners for the most part are also following the seasonal script, ramping up output as we approach the peak driving demand season which unofficially kicks off in 10 days. PADD 2 refiners didn’t seem to be learning any lessons from last year’s basis collapse and rapidly increased run rates last week, which is another contributor to the weakness in midwestern cash markets. One difference this year for PADD 2 refiners is the new Transmountain pipeline system has eroded some of their buying advantage for Canadian crude grades, although those spreads so far haven’t shrunk as much as some had feared.

Meanwhile, wildfires are threatening Canada’s largest oil sands hub Ft. McMurray Alberta, and more than 6,000 people have been forced to evacuate the area. So far no production disruptions have been reported, but you may recall that fires in this region shut in more than 1 million barrels/day of production in 2016, which helped oil prices recover from their slump below $30/barrel.

California’s Air Resources Board announced it was indefinitely delaying its latest California Carbon Allowance (CCA) auction – in the middle of the auction - due to technical difficulties, with no word yet from the agency when bidders’ security payments will be returned, which is pretty much a nice microcosm for the entire Cap & Trade program those credits enable.