Energy Futures Are Ticking Modestly Lower To Start Christmas Week

Energy futures are ticking modestly lower to start Christmas week trading with few headlines to make waves while many around the world shift focus away from their screens.

NYMEX contracts will have an early close Tuesday, and will be completely shut Wednesday, with normal trading sessions Thursday and Friday. Spot markets will be assessed every day except Wednesday.

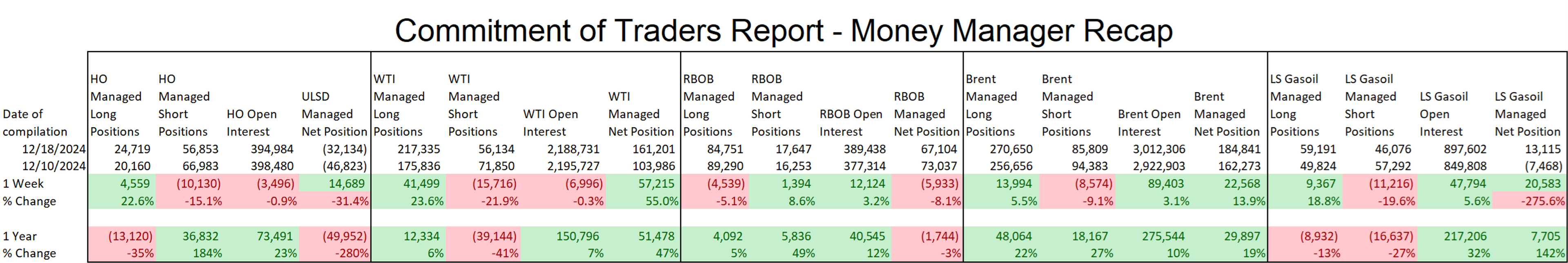

Money managers were decidedly bullish in the latest CFTC COT report adding more than 115,000 contracts of net length to crude oil and diesel contracts with a combination of new long positions and covering shorts. That suddenly bullish stance should probably not be surprising for the large speculative trading category known for their bandwagon jumping tendencies given that the market had risen 5 out of 5 days in the week prior to the report’s composition. The fact that prices have dropped 3 out of 4 days since the data was compiled should also not be surprising as money managers have had a particularly rough time trying to time the market this year.

Baker Hughes reported an increase of one oil drilling rig active in the US last week, while the natural gas drilling rig dropped by one. The EIA this morning highlighted how continued operational efficiency has allowed the US to set the all-time world record for oil production, despite the lower rig count.

While US drilling activity has stagnated this year, and many predict 2025 will not see much change, Canada’s rig count saw a notable year/year increase of nearly 25% as the Transmountain pipeline expansion allowed domestic producers to crank up production.

Valero reported an upset at its 3 Rivers TX refinery over the weekend, which impacted 2 different Sulfur Recovery Units, and lasted at least 24 hours. Given the inland location of that facility, it’s unlikely to have any impact on USGC spot basis differentials.

Marathon reported unplanned flaring in the Wilmington section of its LA-area refining complex Sunday. That facility makes up the largest refining complex on the West Coast, and with LA spot gasoline already seeing a 25 cent increase last week due to unplanned events, it wouldn’t be surprising to see more increases due to that latest upset. The good news for those hoping to avoid the latest basis spike in the region is that we’re about to start 3 of the slowest weeks for demand of the entire year, which might help keep a lid on the buying.

Latest Posts

Market Fluctuations Caused By Uncertainty With Tariff Policies

Week 5 - US DOE Inventory Recap

Oil Prices At Lowest Of The Year

Refined Products Futures Prices Are Up This Morning

Refined Products Futures Prices Are Up This Morning

Energy Market Highlights Q4

Social Media

News & Views

View All

Market Fluctuations Caused By Uncertainty With Tariff Policies

Week 5 - US DOE Inventory Recap